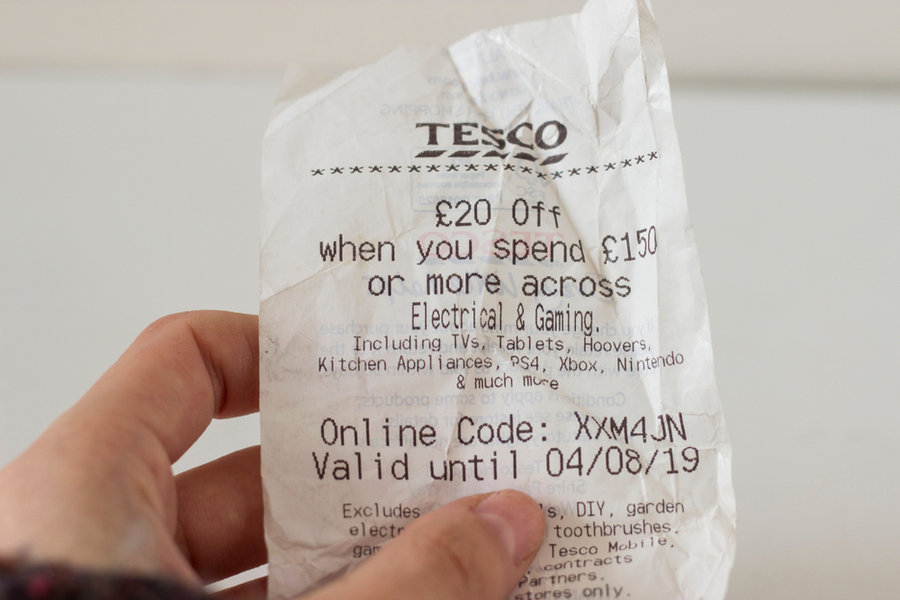

The cashier is ringing up your Tesco purchases and asks if you want the receipt with you or in the bag. You smile and say, “with me,” then glance at your receipt and notice a star or * printed next to some items but not others.

If you’re wondering what that star indicates, you’ve come to the perfect spot – this article will explain everything you need to know about the Tesco star.

Items at Tesco that have a star next to them on your receipt indicate that the item you purchased has a Value-Added Tax (VAT) on it.

A VAT is a popular means of taxing goods and merchandise. It is considered a consumption tax, meaning the people who purchase whatever goods or services the VAT applies to are the ones who shoulder the tax burden.

We’ll dive deeper into the pros and cons of VATs in this article.

If you live in the US, you might not know what Tesco is. This article will give a summary of the company.

If you notice a star on your Tesco receipt, you paid a VAT for the starred item. However, not every good or service is subject to VAT. This article will cover some things that do and do not get hit with VAT.

What Is Tesco?

Tesco is a multinational retailer that was founded and is headquartered in England.

There are now Tescos in 11 countries. Tescos sell both groceries and general merchandise.

Some items that Tesco sells are subject to VAT, while others are not.

1. Items at Tesco That Aren’t Subject to a VAT

Take a close look at your receipt from Tesco. Do you notice any trends or themes regarding which items are starred?

Generally speaking, most food items are zero-rated. This means that there is no VAT applied to them. Staples such as meat, bread, fruits, and vegetables are rarely subject to a VAT.

Items like children’s clothes are also not subject to VAT (at least in England). Other essential items in England, like car seats and energy, are available at a reduced VAT of 5% instead of the standard 20%.

2. Items at Tesco That Are Subject to a VAT

Although most food items aren’t subject to VAT, some are. For example, think of your favorite salty snack or sugary treat.

A VAT is typically applied to these items because the government wants to discourage poor eating habits (and inflated healthcare prices that come with them) and because these items offer little nutritional value.

Other foods like soft drinks and alcohol are also subject to a VAT.

But it’s not just junk food and alcohol that the government applies a VAT to. So, for example, almost all the merchandise sold at Tesco gets hit with a VAT (except children’s clothing and shoes).

Though not sold at Tesco, financial and real estate transactions do not typically have a VAT imposed upon them.

What Is a Value-Added Tax?

A value-added tax (VAT) is a consumption tax on goods and services. VATs are added at every level of production. The raw material, factory, wholesaler, retailer, and consumer pay VAT.

Though VATs apply at every production level, the consumer foots the bill of the entire VAT. The factories, manufacturers, and retailers pass their taxes to the consumer.

If you live in the United States, your country does not have a VAT. The Federal government raises money through income tax and other taxes instead.

However, VATs are common in Europe, and if you live there, the goods and services you consume are likely subjected to VAT. The percentage of tax varies by country.

VATs are uncommon throughout the rest of the world. So do a deeper dive into the country you live in to discover if they employ a VAT or not.

How VATs Work

VATs are commonly expressed as a percentage of the total cost. England has a 20% VAT, for example. This means that for a $100 product, a consumer will pay $120, of which $100 goes to the merchant and $20 goes to the English government.

VATs are similar to a national sales tax, with the difference being that VATs are collected at multiple stages. The raw materials, factory, wholesaler, retailer, and the consumer pay a VAT at every production stage.

But, again, all the costs of the VAT incurred by the factory, retailer, etc., are passed along to the consumer, and it is they who shoulder the entire tax burden of a VAT.

On the other hand, national sales taxes are only collected at the point of sale. Therefore, the factory or wholesaler does not incur tax fees, for example.

Many people and economists prefer VAT because it is a transparent form of taxation. When you buy goods or services, consumers know that the VAT is baked into the cost and adjust their spending accordingly.

You know the tax is there if an item or service has a VAT.

Contrast this with a hidden tax. In America, gasoline and alcohol are taxed, but consumers are typically unaware of the tax rates and whether that money goes to local, state, or federal funds.

Critics argue that these hidden taxes obfuscate how governments raise money and are not transparent with consumers.

So That’s Why That Star Is There

So, the star on your receipt from Tesco indicates that the item you purchased was subject to a VAT.

With all the knowledge you’ve gleaned about the history of Tesco, and the pros and cons of a VAT, you should throw a dinner party and wow your guests with your now vast pool of knowledge.

There are proponents and critics of the VAT. Critics argue that it places a heavier burden on taxpayers who aren’t wealthy, while proponents say it’s a good way for governments to raise funds and is more transparent than hidden taxes.

Ultimately, the decision is yours if you think VATs are good or bad. But, if you live in Europe, you’ll have to continue paying them regardless.

Frequently Asked Questions

Are VATs Effective?

As with all taxation systems, there is a broad spectrum of disagreement. For example, conservatives dislike taxes, particularly on the wealthy, while progressives are considered pro-tax.

Many economists believe that VATs are effective and a good way for a country to grow its GDP, raise its tax revenue and pay off or cut its budget deficit.

Critics of VATs argue that it is essentially a flat tax that everyone pays. This means that VATs are a regressive tax, and poor and middle-class people often shoulder a more significant burden as a percentage of their income.